- whyCrypto

- Posts

- NFT vs Crypto: Understanding the Key Differences and Investment Opportunities

NFT vs Crypto: Understanding the Key Differences and Investment Opportunities

Unlocking the Potential of Digital Ownership

NFT vs Crypto: Understanding the Key Differences and Investment Opportunities

NFTs

Introduction

For newcomers, the blockchain space can seem complex and challenging to navigate. This is understandable given the significant innovations brought by digital assets. At its core, blockchain is a digital ledger that records data transactions. Among its many applications, two of the most prominent are cryptocurrencies and NFTs (Non-Fungible Tokens). Both are essential to understanding the blockchain ecosystem, especially when considering investments in this field.

NFTs and cryptocurrencies have garnered significant attention in both financial and artistic communities. They represent critical types of data transactions within the blockchain network. For example, a single NFT has been sold for nearly $70 million, while the well-known cryptocurrency Bitcoin has popularized the concept of investing in digital tokens. Despite some similarities, NFTs and cryptocurrencies are distinct in many ways. This article explores the fundamental differences between these two types of digital assets and provides guidance on investing in NFTs.

What is an NFT?

A Non-Fungible Token (NFT) is a type of cryptographic token that is unique and cannot be exchanged on a one-to-one basis with another NFT. These tokens are created using blockchain technology, which ensures their uniqueness and ownership. NFTs can represent various digital assets, such as artworks, songs, or video clips, stored on the blockchain. To illustrate, consider a first-edition pair of custom sneakers or a rare collectible coin; these items are unique and not easily replaceable with another similar item. Similarly, NFTs are non-fungible, meaning they are unique and indivisible.

Unlike cryptocurrencies such as Bitcoin, NFTs cannot be divided into smaller units and can only be owned by one person or entity at a time. This non-interchangeability is what primarily sets NFTs apart from cryptocurrencies.

How are Cryptos Different from NFTs?

While both cryptocurrencies and NFTs are digital assets that can be bought, sold, and traded using digital currencies like Bitcoin or Ethereum, they serve different purposes and have distinct characteristics. Both are decentralized and operate independently without any centralized authority, relying instead on blockchain's distributed ledger technology. However, their key differences lie in their interchangeability and representation.

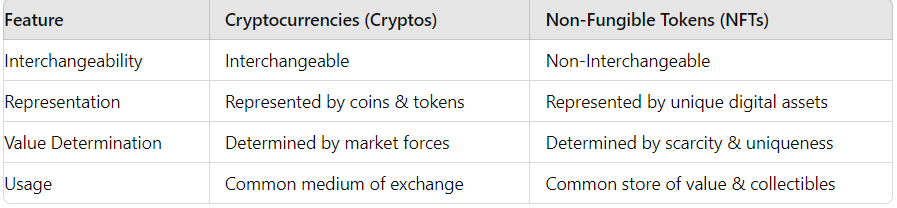

Key Differences Between Cryptos and NFTs

Crypto & NFTs

Advantages and Disadvantages

Cryptocurrencies

Advantages:

Security and Decentralization: Cryptocurrencies offer a secure, decentralized method of payment, allowing for transactions without the need for third-party intervention.

Borderless Transactions: They enable quick and easy international transactions, making them ideal for cross-border payments.

Regulatory Flexibility: Cryptos may not be subject to the same regulations and taxes as traditional fiat currencies, which can be appealing to users.

Disadvantages:

Volatility: The crypto market is highly volatile, with asset prices subject to rapid fluctuations due to market conditions.

Non-Fungible Tokens (NFTs)

Advantages:

Uniqueness and Indivisibility: NFTs are unique digital assets that can represent both physical and digital items, ensuring that each token is one-of-a-kind.

Immutability: Ownership and data of NFTs are immutable, meaning they cannot be altered or tampered with once recorded on the blockchain.

Disadvantages:

Complexity: NFTs are still a relatively new technology and can be difficult for beginners to understand.

Cybersecurity Risks: As digital assets, NFTs are vulnerable to cyberattacks and hacks, which can result in the loss of value and assets.

Why are Cryptocurrencies and Blockchain Related to NFTs?

Cryptocurrencies and blockchain technology are fundamentally related to NFTs for several reasons:

Blockchain Technology: NFTs are created and stored using blockchain technology. This decentralized digital ledger ensures the security, transparency, and immutability of NFTs. The blockchain records all transactions involving NFTs, making it possible to verify ownership and authenticity. This same technology underpins cryptocurrencies, ensuring secure and transparent transactions.

Cryptocurrency Payments: Most NFT transactions are conducted using cryptocurrencies, particularly Ethereum (ETH). To purchase an NFT, investors typically need to buy cryptocurrency first, which they then use to complete the transaction on various NFT marketplaces. This integration makes cryptocurrencies a vital component of the NFT ecosystem.

Smart Contracts: NFTs are often created using smart contracts, which are self-executing contracts with the terms of the agreement directly written into code. These smart contracts are deployed on blockchain networks like Ethereum. Cryptocurrencies also utilize smart contracts to facilitate and automate transactions, highlighting the interconnectedness of these technologies.

Decentralization: Both cryptocurrencies and NFTs operate on decentralized networks, removing the need for central authorities or intermediaries. This decentralization ensures that transactions are secure, transparent, and resistant to censorship or manipulation.

Investing in NFTs

Where to Invest in NFTs

NFT Marketplaces: The most common way to invest in NFTs is through online marketplaces. Some of the most popular platforms include:

OpenSea: One of the largest NFT marketplaces, offering a wide variety of digital assets including art, domain names, and collectibles.

Rarible: A community-owned marketplace that allows users to create, buy, and sell NFTs.

SuperRare: A platform focused on single-edition digital art, ensuring the uniqueness of each piece.

Foundation: An invite-only marketplace for artists and collectors, known for high-quality digital art.

Direct Purchase from Artists: Some artists sell NFTs directly through their own websites or social media channels. This can be a good way to support creators and potentially invest in unique pieces.

Auction Houses: Traditional auction houses like Christie's and Sotheby's have also entered the NFT space, offering high-profile digital art auctions.

How to Invest in NFTs

Set Up a Digital Wallet: To buy NFTs, you need a digital wallet that supports cryptocurrency transactions. Wallets like MetaMask, Trust Wallet, and Coinbase Wallet are popular choices.

Purchase Cryptocurrency: Most NFT transactions are conducted using Ethereum (ETH), so you will need to purchase ETH from a cryptocurrency exchange like Coinbase, Binance, or Kraken.

Choose Your Marketplace: Select a marketplace based on your interests and the type of NFTs you wish to invest in. Each platform has its own registration process and transaction fees.

Research and Due Diligence: Before making a purchase, thoroughly research the NFT and its creator. Look into the artist's background, the rarity of the asset, and its historical value.

Make the Purchase: Once you have identified an NFT to buy, follow the marketplace's instructions to complete the transaction using your digital wallet.

Store Your NFT Safely: After purchasing, ensure that your NFT is stored securely in your digital wallet. Consider using hardware wallets for added security.

Important Factors for NFT Investors

Market Trends: Stay informed about market trends and emerging artists. The value of NFTs can fluctuate significantly based on market demand and trends.

Utility and Use Cases: Some NFTs offer additional utility beyond ownership, such as access to exclusive content, events, or digital communities. Assess the potential use cases of an NFT before investing.

Liquidity: Unlike cryptocurrencies, NFTs can be less liquid. It may take time to find a buyer willing to pay your desired price, so consider the liquidity risk.

Legal and Regulatory Considerations: The regulatory environment for NFTs is still evolving. Be aware of the legal implications and tax responsibilities associated with NFT investments.

Diversification: As with any investment, diversification is key. Avoid putting all your funds into a single NFT or artist. Spread your investments across different types of NFTs and creators.

Conclusion

Understanding the differences between NFTs and cryptocurrencies is crucial for navigating the blockchain landscape. Both represent innovative uses of blockchain technology but serve different purposes and offer unique benefits and challenges. For those looking to invest in NFTs, it's essential to conduct thorough research, understand the market, and be aware of the risks involved. By comprehending these distinctions and following best practices for investment, investors can make informed decisions and potentially benefit from the growing digital asset market.

Join Our Community |

Stay ahead in the crypto market with cutting-edge AI-driven crypto trading insights. Subscribe to our Telegram channel, Rocketz AI Crypto Bot, for advanced algorithms delivering impressive returns. |

© 2024 whyCrypto. All rights reserved. |

Reply